The Go-To VC Firm for

Product-First Companies

In This New Decade,

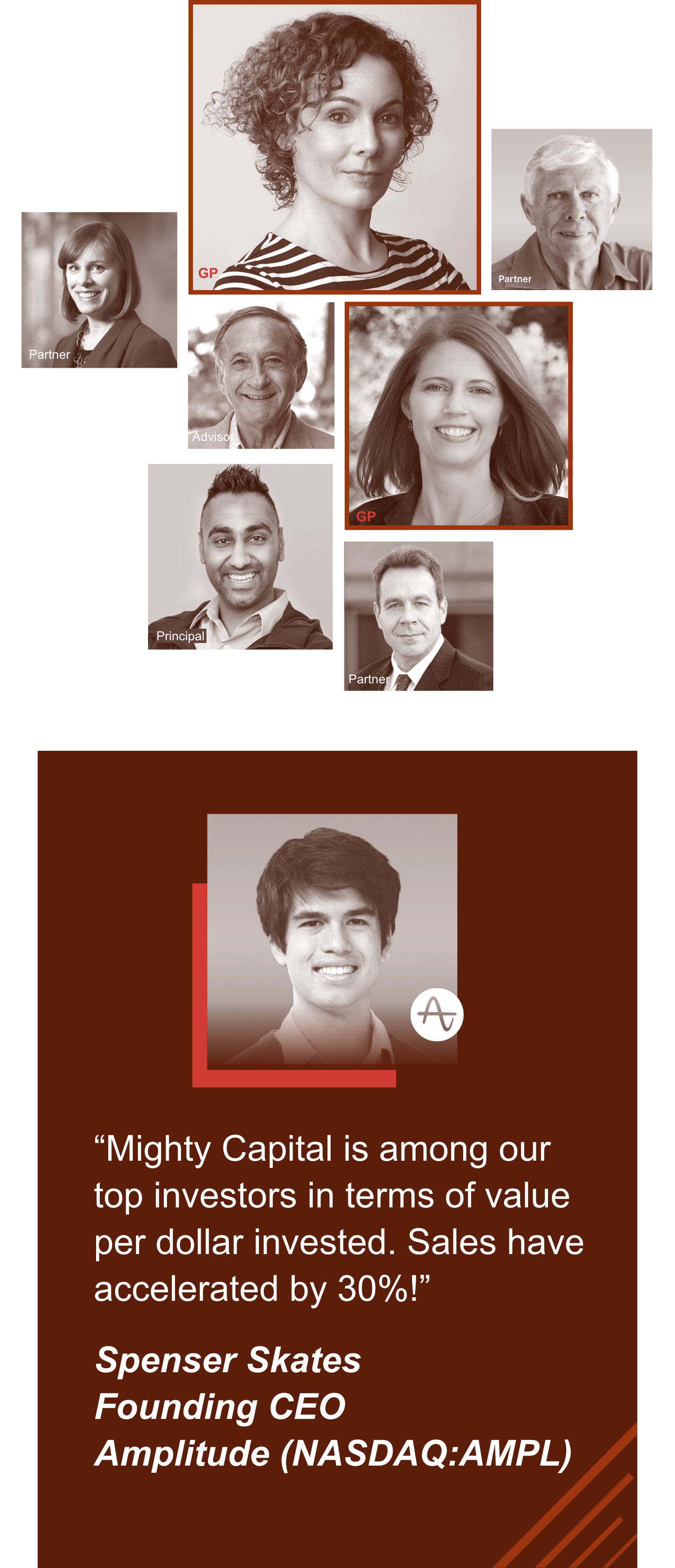

Mighty Capital® is a VC firm that gives its portfolio companies exclusive access to >500,000 PMs and a playbook to turn them into customers.

By partnering with Mighty Capital®, Amplitude founding CEO Spenser Skates sold $-millions to Fortune 5000 PMs, and created a $-billion market leader. We back entrepreneurs like Spenser, who are raising a Series A on fair terms, to sell amazing products to PMs at scale.

Connect and collaborate with product leaders at scale.

A fundamental component to our portfolio companies’ success is Products That Count, the most influential global product acceleration platform that provides:

- Founder-friendly due diligence

- Sales channels to generate revenue

- Hiring pools to source rare talent

- Liquidity paths that product execs often initiate

We meet you where you’re at and empower you for growth.

Ready for Hyper Growth

You’re an entrepreneur looking to accelerate your company’s growth. You’re seeking new revenue streams and ready to fundraise.

LEARN MORE

Make Money vs Raise Money

Your product has traction and you’re considering next steps. Consider improving your pitch and pitching for feedback.

LEARN MORE

Go-to-Market Game Changer

You’ve got questions about your strategy. We’ve got a proven playbook that accelerates go-to-market success.

LEARN MORE![]() For more information or inquiries, email us at [email protected]

For more information or inquiries, email us at [email protected]